EMERALD SKYLINE CORPORATION

Emerald Skyline Corporation has partnered with Hannon Armstrong Sustainable Real Estate (Sustainable REIT and PACE Financing) to provide low-cost, long-term PACE financing to commercial property owners. Emerald Skyline represents PACE in Florida and 35 other states in which PACE is currently operating. The PACE program is designed for sustainable, energy-efficient and resilience initiatives for new and existing buildings. Through our knowledge and experience, Emerald Skyline will provide financing programs that help real estate property owners and developers capture the many benefits of PACE programming.

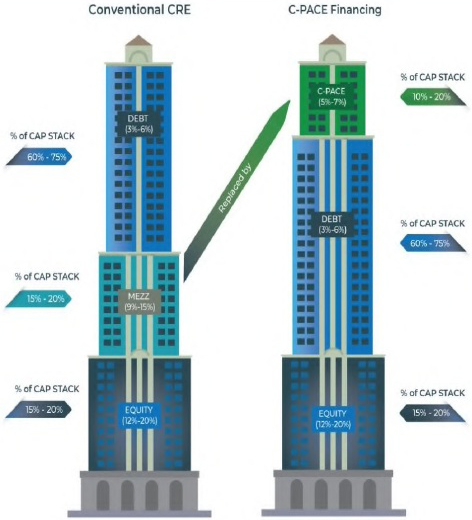

C-PACE financing is an excellent means to finance commercial building energy upgrades. Building owners will benefit from PACE financing by lowering energy costs, lowering capital costs, lowering operating expenses, providing increased cash flow, while creating higher property values.

- 100% financing, no upfront costs

- Cash flow positive from day one

- Frees your capital budget, allowing investment in additional high return opportunities

- Energy savings fund PACE assessment payments

- Non-recourse to property owner, non-accelerating

- Property owner keeps tax credits and rebates when available

- Increases net operating income & property value

- Decreases maintenance costs

- Fixed rates up to 30 years

- Assessment balance transfers upon sale of property

C-PACE PRIMER

100% Project Financing: Finance 100% of your sustainable project up to 35% of the property’s appraised value. Project costs include design, engineering, permits, service contracts & hard costs.

Long-term Fixed Rates: Projects are financed over the useful life of the improvement with fixed long-term interest rates between 5.5% and 7.5% with fully amortizing terms from 5 to 30 years.

Transferable: C-PACE Special tax assessments are tied to the land and can transfer with the sale of the property as supported improvements are permanent and fixed. C-PACE loans do not have a due-on-sale clause.

Flexible Prepayment Options: C-PACE financing provides flexible prepayment options that allow building owners and developers to effectively manage the property’s capital structure.

The primary goal with C-PACE financing is to lower the cost of entry for sustainable, resilient and renewable energy capital improvements, thereby facilitating profitable investments and improved operating efficiencies for owners.

For more information contact Abraham Wien at: 305-609-9093 or [email protected]